Calculating Capitalization Rate

The common measure of rental real estate value based on net return rather than gross rental income is the Cap Rate.

Before you can calculate a value or return based on a cap rate, you will need to know the Net Operating Income of the property (NOI).

What Is NOI? Net operating income (NOI) equals all revenue from the property, minus operating expenses. NOI is a before-tax figure which excludes principal and interest payments on loans, capital expenditures, depreciation, and amortization.

NOI = Annual Rent Amount minus Annual Operating Expenses

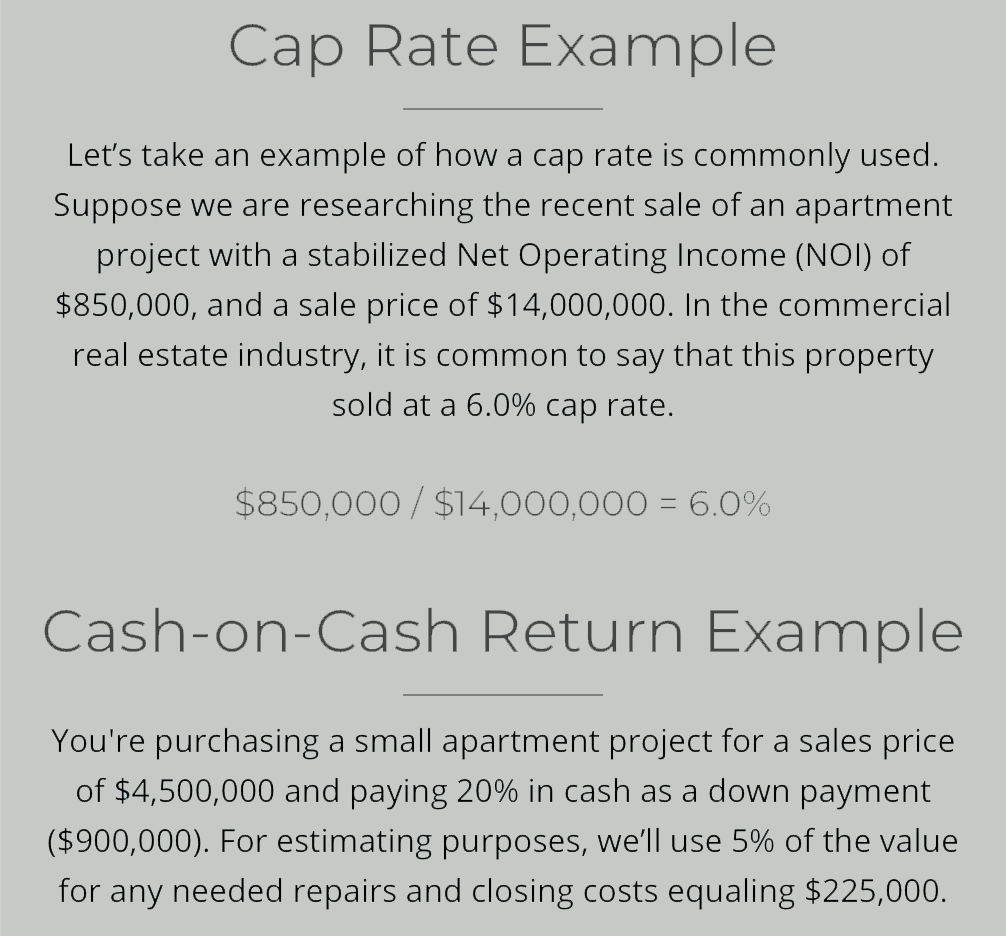

An example to understand the cap rate is that it represents the percentage return an investor would receive on an all cash purchase. Please see the provided example.

What determines an "acceptable" Cap Rate? Ultimately it depends on how you are using it. For example, if you are buying a property then a higher cap rate is good because it means your initial investment will be lower. However, if you are selling a property, then a lower cap rate is appropriate because it means the value of your property will be higher.

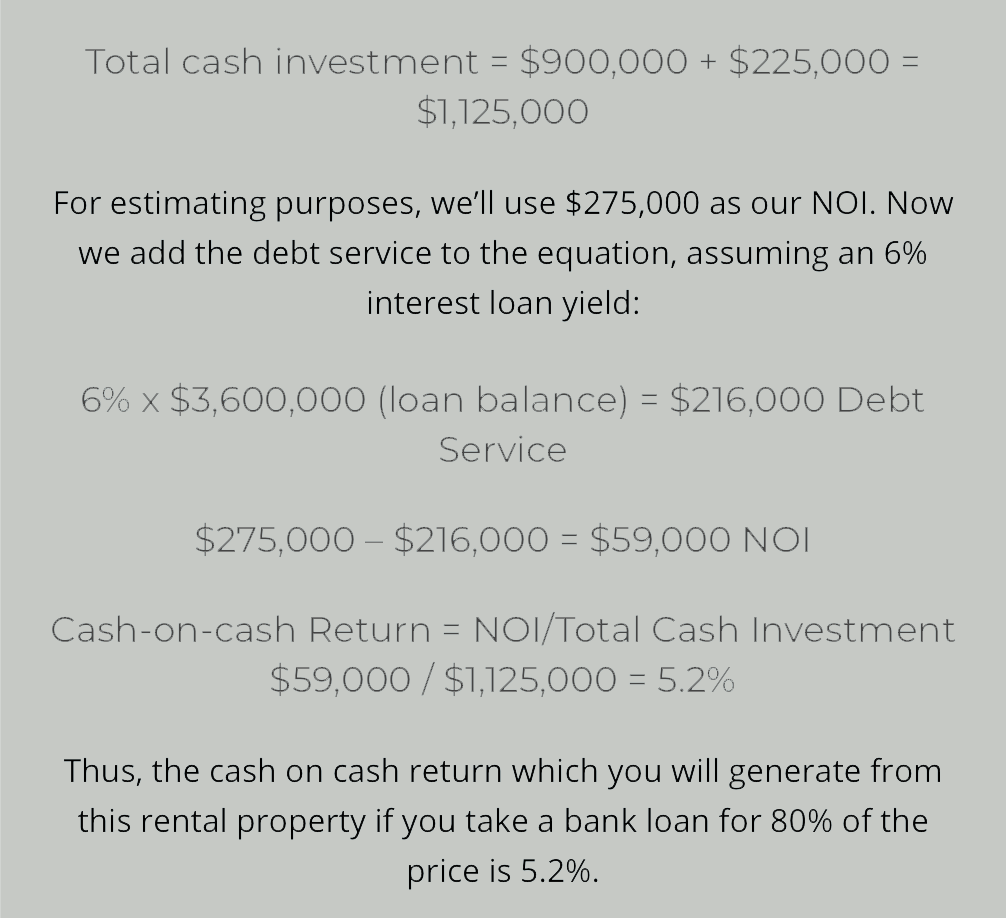

What Is Cash-on-Cash Return ? The cash-on-cash return is the ratio of annual before-tax cash flow (after debt service) to the total amount of cash invested, expressed as a percentage. To get to a value, you must divide the cash flow by the net operating income (NOI) before tax by the amount of cash initially invested.

However, the cash-on-cash return is a simple metric and does not tell everything about an investment property. Some items not factored are appreciation or tax benefits.

CoC Return = NOI/Total Cash Investment

To calculate a cash on cash return, you will need to know the Net Operating Income (NOI) of the property.